As China continues its path of expansion through its Belt Road Initiative businesses have benefited by leveraging this opportunity to expand abroad. However, while pursuing such expansion goals, businesses are often faced by a multitude of unprecedented challenges that comes with higher transaction volumes and increased organizational complexity:

- Funds and bank accounts are scattered around the globe with little managerial efficiency

- Lack of a centralized solution to pay disparate overseas vendors and suppliers around the world

- Differing time zones and lack of business synergy due to foreign business practices rooted in cultural and language differences

- Businesses with overseas subsidiaries are susceptible to FX fluctuations due to geopolitical uncertainties or natural calamities

To tackle the above challenges, businesses can consider setting up a treasury centre to optimize their fund flows, improve risk control, as well as consolidate account oversight to provide more comprehensive support to business units in the region.

However, businesses operating in multiple markets and regions often favour a more diversified approach to managing their organizations. In such cases, their approaches are measured by the nature of their operations and the concentration of funds in various markets. For such organizations, a singular treasury centre may not suffice in providing the necessary operational support. In order to manage their funds more efficiently, such businesses would require a regional approach to setting up treasury centres that can act as a springboard for scaling globally.

Business Giants Uncovering the Benefits of Dual Treasury Centres in Hong Kong and Singapore

In recent years, more and more businesses have strategically sought to establish treasury centres in Hong Kong and Singapore. For instance, when considering its global operations, Huawei set up global financial risk control centres in Hong Kong and Singapore to reduce cost and financial risk. Additionally, Huawei also set up an Innovation Centre in Singapore to help nurture and establish a comprehensive global technological eco-system. Other global giants such as ByteDance and Tencent have also identified Singapore and Hong Kong as key strategic springboards for furthering their global expansion.

Why Hong Kong and Singapore?

Superior Business Expansion Opportunities, Higher Financial Management Efficiency

As a global financial centre, Hong Kong is the world’s largest offshore RMB centre. With its proximity to mainland China, robust financial system, as well as effective and efficient capital flows, Hong Kong is a strategic location for setting up a treasury centre to help businesses access Euro-American markets and open up trade paths. Borrowing on Hong Kong’s free trade policy and its unique entrepot trade positioning, businesses can increase the efficiency of their treasury management efforts.

On another level, as China deepens its trade and financial relations in Southeast Asia, including being signatory to the Regional Comprehensive Economic Partnership (RCEP), the region has gained attractiveness for businesses for businesses in search of scale. Within Southeast Asia, Singapore has established itself as the main centre for trade, finance, and shipping. As a vital springboard for conquering the broader Southeast Asian market, setting up a treasury centre in Singapore can act as a reinforcement to the vibrant flows that businesses already benefit from Hong Kong, helping them to reach the Southeast Asian market and beyond through greater inter-connectivity.

SUNRATE: Supporting Businesses’ Global Expansion Efforts

As a financial technology company dedicated to supporting global payments and treasury management solutions, SUNRATE has continuously strived to help businesses build a digitized trade ecosystem.

Officially Licensed to Support Dual Treasury Centres

SUNRATE is officially licensed by relevant regulatory authorities in UK, Hong Kong, USA, Europe, Japan, Singapore and other markets and is equipped with the requisite capabilities to support businesses to execute effective cross-border payments and transfers. Furthermore, SUNRATE is one of a select few financial institutions that have been awarded the MPI license in Singapore – which authorizes financial institutions to set up accounts, facilitate domestic and cross border payments, as well as to offer acquiring and e-money issuance services. For companies looking to expand to, or have already entered the Singapore market, SUNRATE can offer virtual accounts, payment services, transactional FX, corporate cards, and other digital services to help businesses establish a one-stop treasury management solution. Through SUNRATE’s continued localization efforts, we can support businesses set up global accounts to manage global financial flows, execute efficient risk management, and to continue the virtuous cycle of trade expansion.

A Flexible and Effective One Stop Solution for Global Payments and Collection

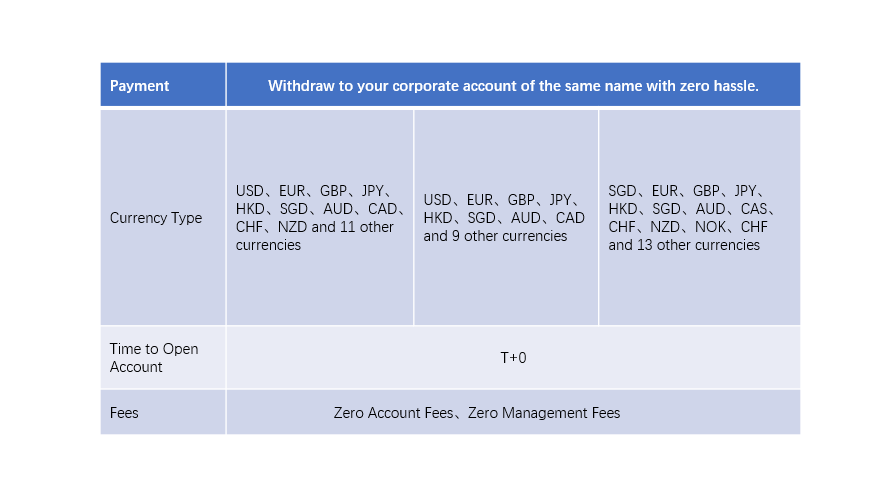

Global Collection Account Capabilities

Emerging Market Currencies

We also have collection capabilities in the UAE, Thailand, Poland, Kenya as well as several other countries to further support businesses looking to access newer markets.

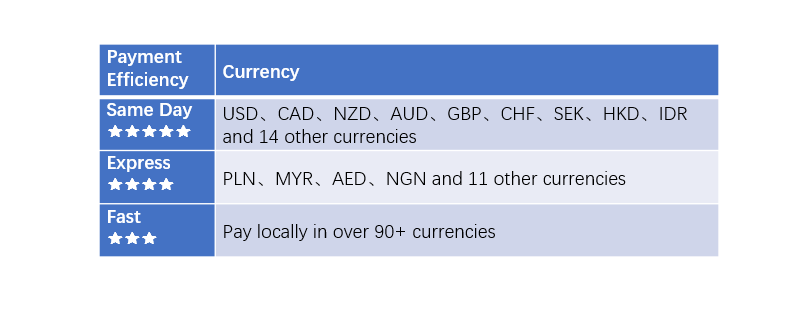

Extensive Global Payment Capabilities

In order to fulfil the diverse payment needs of different suppliers, SUNRATE covers over 130+ markets and over 100+ currencies with real time FX rates and efficient fund delivery that are fully secure and compliant.

Note:

SUNRATE: Real Time and Transparent

Digitally connected to the global payment network and the inter-bank FX market, businesses can leverage the SUNRATE platform to check for real time and transparent rates to reduce costs associated with payment.

Risk Management SaaS: Supercharging Treasury Management Through Digital Technology

Apart from providing clients with efficient and cheap payment services, SUNRATE also offers a simple-to-use and responsive risk management SaaS. This Risk Management SaaS covers the risk associated with the full forex life cycle to help businesses effectively identify and quantify risks, provide forecasts and exposure analysis, as well as offer hedging strategy recommendations. Armed with this information, businesses can effectively optimize their fund flows and tackle the risks associated with cross-border payments more precisely.

Additionally, SUNRATE has also launched its new WorkOS SaaS, a multi-currency treasury management platform to help business automate ERP workflows through tracking of account receivables and payables to increase visibility of cash flows and increase bookkeeping efficiency.

SUNRATE continues to strive to expand its product innovation capabilities, compliant system algorithms and dedicated service capabilities through partnerships and continued innovation. In order to support businesses through digitized payment and treasury management services in an increasingly multi-faceted and dynamic payment landscape, our dual treasury centres enable us to provide centralized treasury management, open payment corridors in various markets and empower businesses to realize their expansion goals.

Share to

We hope to use cookies to better understand your use of this website. This will help improve your future experience of accessing this website. For detailed information on the use of cookies and how to revoke or manage your consent, please refer to our < privacy policy >. If you click the confirmation button on the right, you will be deemed to have agreed to use cookies.